Yochai Benkler at HLS

John provides a good summary of Yochai Benkler’s interesting and enjoyable talk at HLS yesterday. It was a 30 minute distillation of his new book, The Wealth of Networks.

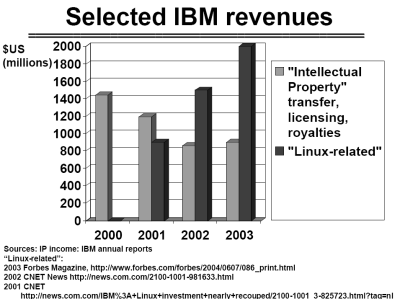

One slide in particular jumped out to me during the presentation. It showed a micro-view of IBM’s revenue breakdown comparing Linux-related activities and traditional IP royalties and licensing revenues. Yochai showed this graph as part of a pattern that he points to in which collaborative peer-based production is 1) happening, 2) measurable and 3) large scale in certain applications. I found what I believe to be a similar version of this slide in some random PDF that Google dug up for me (see slide 5).

But my reaction to this slide was that there’s almost no conclusion about the scope of change that you can come to by looking at four numbers showing a one-dimensional view of IBM’s revenue.

But my reaction to this slide was that there’s almost no conclusion about the scope of change that you can come to by looking at four numbers showing a one-dimensional view of IBM’s revenue.

First of all, the big Linux push was being led between 1998 and 2000 by traditional open source companies like RedHat, VA Linux, but the events that really pushed Linux into enterprise computing were the near-simultaneous announcements in September and October, 1998 from Sybase, IBM, Informix and Oracle (in that order) that they would release some of their database products for Linux. SAP followed suit a year later and everything afterwards happened without all the fanfare of the early announcements.

Given this context, it’s not surprising that the Linux activities don’t have a lot of associated revenue in 2000. It was in 2001 that IBM announced a billion dollar marketing push for the little operating system that could. That was their first big public commitment to the platform.

In 2002, IBM bought PriceWaterhouseCoopers (that had laughably renamed itself as Monday shortly beforehand). That revenue is now part of the IBM Global Services consulting bucket. So while there’s a lot of service revenue likely associated with Linux-related activities, the profit margin on this business doesn’t even compare to what IBM makes for software. IBM conveniently announced earnings yesterday, so let’s look at those:

INTERNATIONAL BUSINESS MACHINES CORPORATION

COMPARATIVE FINANCIAL RESULTS

(Unaudited; Dollars in millions except per share amounts)

Three Months Ended March 31

Percent

2006 2005* Change

------- ------- -------

REVENUE

Global Services $11,567 $11,709 -1.2%

Gross profit margin 26.6% 24.3%

Hardware 4,574 6,754 -32.3%

Gross profit margin 31.1% 27.5%

Software 3,907 3,814 2.4%

Gross profit margin 84.2% 83.8%

We learn that IBM makes serious money on services: $11.5B. That’s a lot. And they only made $3.9B on software. But they actually made $212M more profit from software than they did from services. And I’m guessing that a large portion of the intellectual property licensing business in the slide above is actually accounted for by software sales.

Go and look at the CNET article referenced by the slide. There’s a quote:

Three and a half billion dollars in revenue–not bad for a free operating system," said James Governor, an analyst at research firm Redmonk.

He’s right, that’s not bad for a free operating system. But they’re not selling

$3.5B worth of a free operating system. Most of that number is servers sold with some Linux distro pre-installed. Sure, Linux is helping to drive the sales, but it’s misleading to think that anybody has sold billions of dollars worth of free software.

In short, I’m not sure what that slide is showing except that IBM makes a lot of money doing something and that Linux is apparently involved to some degree. Maybe you’ll just have to read Yochai’s book to make up your own mind about all this.